Wall Street rarely shows signs of stress without cause. But right now, the pressure is building. Despite optimistic political rhetoric, cracks are forming in the U.S. economy. Volatility is rising, corporate profits are slipping, and overall growth shows signs of fatigue. While the data hasn’t officially confirmed a recession, it’s edging closer to doing so.

Take the S&P 500, for instance. Between mid and late March, the index climbed sharply from 5509 to 5790, reflecting an upbeat market mood. But sentiment shifted fast after President Donald Trump unveiled new tariffs dubbed ‘Liberation Day.’ The announcement caught traders off guard, sparking a swift selloff. Markets then bounced on news of a temporary pause, only to tumble again amid renewed uncertainty. Once the pause was confirmed, a massive rally followed, with the NASDAQ logging a single-day gain of 1,857.06 points. Such wild swings aren’t typically rooted in confidence. They reflect anxiety.

Meanwhile, the Federal Reserve remains cautious. With inflationary pressure tied to tariffs complicating the economic landscape, Chair Jerome Powell has kept interest rates steady. The Fed is walking a tightrope. Cut rates too soon, and inflation might reaccelerate. Leave them high, and growth risks stalling. Should inflation and economic weakness emerge simultaneously, stagflation could become a reality.

Consumer behaviour is also signalling distress. April saw the University of Michigan’s Consumer Sentiment Index drop 11%, marking its fourth consecutive decline. The downturn is widespread, affecting all political affiliations, income levels, and education groups. Concerns about job security are growing, and with uncertainty on the rise, household spending is pulling back, further dampening growth prospects.

On the industrial front, the Empire State Manufacturing Survey paints a grim picture. Current conditions sit at -8.1%, and future expectations are even worse at -7.4%. These figures rank among the weakest in over two decades, worse than the early stages of the 2008 financial crisis and the COVID-19 pandemic. Only the aftermath of 9/11 saw lower expectations.

Corporate America is bracing for a slowdown. Earnings forecasts for S&P 500 firms have been revised downward by 48%, Bloomberg reports. That’s the steepest revision since April 2020, when the pandemic first disrupted global markets. This time, it’s policy uncertainty and shaky economic fundamentals driving the pessimism.

The Atlanta Fed’s GDPNow model currently predicts a -2.3% contraction in U.S. GDP for the first quarter of 2025. Some of that dip may be exaggerated due to a rush to repatriate gold ahead of new tariffs, but even after adjusting for anomalies, growth is decelerating. From a robust 3% annual rate over the past couple of years, current estimates have dropped to just 0.3%, according to a CNBC survey.

Bond markets are flashing familiar warning signals. The yield curve has steepened again after previously inverting, a classic recession indicator seen before every U.S. downturn since 1980. Typically, this pattern emerges when the Fed readies itself to ease policy as growth weakens.

For now, the job market remains stable. Unemployment holds at 4.2%, and weekly jobless claims haven’t moved significantly, providing some cushion. The Fed has flagged jobless claims as one of the best leading indicators of recession. If those numbers begin to rise, more pronounced economic declines may follow.

So, while the U.S. hasn’t officially entered a recession, warning lights are flashing across multiple sectors. Growth is slowing, optimism is fading, and risk factors are accumulating. Without a major policy shift or cooling of trade tensions, the threat of a prolonged downturn remains high. The road ahead will require caution from policymakers and investors alike.

Market Movements This Week

Despite a relatively quiet economic calendar, markets remained highly sensitive last week, reacting to geopolitical instability, looming U.S. recession risks, and cautious sentiment among consumers and businesses. Many key currency pairs and commodities are now testing major technical levels as traders await clear direction.

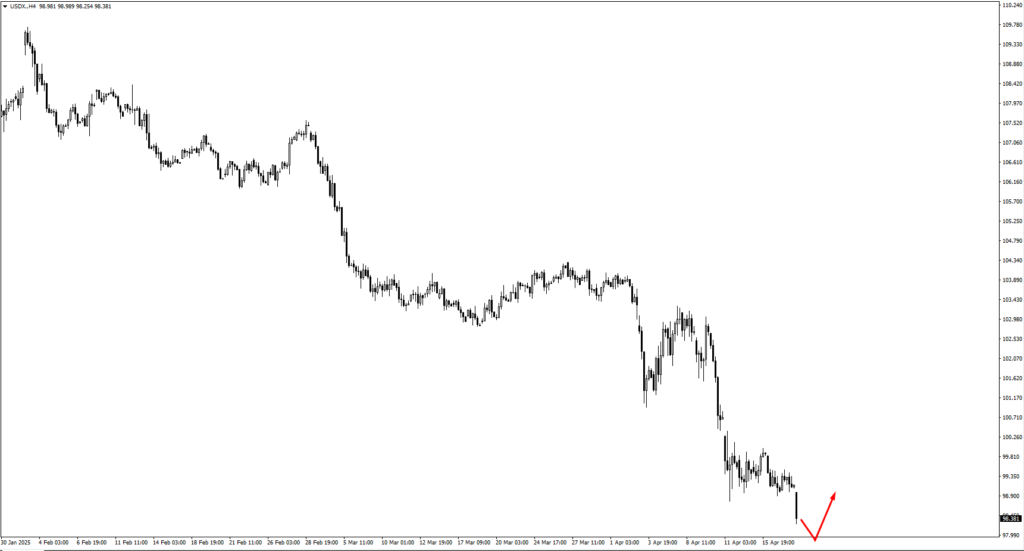

The U.S. Dollar Index (USDX) is beginning to soften after recent strength, with traders closely watching 98.10 and 97.95 for bullish interest should price drift lower. If the dollar regains upward momentum, any approach toward 102.40 will be scrutinized for signs of reversal or continuation. This week, the dollar’s path remains closely tied to risk sentiment and expectations around Federal Reserve policy.

In the EUR/USD pair, bullish setups may emerge if price retreats to 1.1210, while a move upward could encounter resistance near 1.1580. Market participants are eyeing Wednesday’s Flash PMI prints, which could inject short-term volatility depending on whether European data confirms weakening momentum.

GBP/USD has climbed into a zone of interest, with 1.3370 marking the key resistance to monitor. If the level fails to hold, price may briefly break above the 1.34336 swing high before facing renewed selling pressure. Sterling remains highly reactive to signals from the Bank of England, especially as rate cut speculation intensifies.

USD/JPY is showing weakness, drifting lower with a possible test of the 139.572 swing low on the horizon. However, analysts advise caution—further selling may be limited in the short term. Should the pair reverse, 146.60 stands out as a zone to gauge for potential rejection or momentum continuation.

For USD/CHF, price is currently hovering near recent swing lows, but traders are advised to avoid selling at this point. A bounce is anticipated, and if it plays out, 0.8410 will be the key level where bearish price action may re-emerge.

In the commodity currencies, AUD/USD looks poised to inch higher. Traders are watching 0.6415 for a reaction, with expectations of a pullback before any renewed bullish momentum. Meanwhile, NZD/USD fell from the previously watched 0.6000 zone, but the move lacked follow-through. Price is expected to revisit this level again—any fresh reaction there could reveal the next directional clue.

USD/CAD has registered a new swing low, though it hasn’t yet tested the 1.3760 demand zone. If it rebounds from current levels, 1.4140 becomes the critical resistance to watch for potential bearish setups. Oil price fluctuations will likely continue to influence the loonie’s performance throughout the week.

USOil (Crude) remains highly reactive to geopolitical risk. Should price dip, 61.00 is the key level for bullish setups. If crude rises from there, expect sellers to appear around 66.10. But if trade tensions between the U.S. and China escalate, analysts warn that crude could fall sharply, potentially testing 53.00.

Gold (XAU/USD) is back at its all-time high, drawing attention but also caution. Analysts warn against chasing the rally, especially with trade negotiations between the U.S. and China still in flux. If tensions ease, gold could retreat, but if uncertainty continues, a push toward 3430 remains on the table.

The S&P 500 (SPX) appears to be consolidating. A pullback to 5060 would be watched for bullish interest, while any move higher may meet resistance at 5610. Equities are currently walking a tightrope between weaker macro data and earnings season surprises.

Bitcoin (BTC) is showing signs of bullish momentum, but it needs to build more structure before direction becomes clear. Should price break through the 88,763.52 high, the next upside zone to monitor is 92,280. As always, crypto’s direction will depend heavily on liquidity and broader market appetite for risk.

Finally, Natural Gas (NATGAS) continues to trend lower. Bulls may step in if price tests 3.05, 2.95, or 2.80—zones that have previously offered support. However, any meaningful rally will likely hinge on upcoming weather patterns and storage reports.

This week’s market behavior underscores a common theme: uncertainty is tightening the zones, compressing volatility until the next breakout. Across FX, commodities, and crypto, traders are choosing caution—waiting for conviction before stepping back in. With PMI prints and central bank speeches on deck mid-week, the next move could come fast.

Key Events This Week

Market activity during Asian and European sessions may remain subdued unless unexpected headlines shake things up. Many traders will use the early part of the week to position ahead of Wednesday’s data-heavy schedule.

On Wednesday, April 23, a round of Flash PMI releases from the Eurozone, U.K., and U.S. will dominate attention. German Manufacturing PMI is expected to fall to 47.5 from 48.3, while Services PMI may decline slightly to 50.3. Weak results could push the euro lower.

The U.K. will also post its Flash PMIs, with Manufacturing expected at 44.0 (from 44.9) and Services at 51.4 (down from 52.5). GBP/USD could see large moves if the data misses expectations.

In the U.S., Manufacturing PMI is forecast at 49.3, down from 50.2, while Services PMI is expected at 52.9 (previously 54.4). These drops point to a broadening economic slowdown, keeping pressure on the dollar and U.S. yields.

On Thursday, April 24, Bank of England Governor Andrew Bailey will speak, and any hints about upcoming rate moves could shake up UK markets.

The week wraps with SNB Chairman Schlegel’s remarks on Friday, April 25. With the Swiss central bank also weighing rate cuts, traders will watch for guidance that could affect USD/CHF and other CHF pairs.